The biggest change in the history of the Uniform Certified Public Accountant (CPA) exam is happening in January 2024. If you plan to take the CPA exam after this year, you’ll want to make sure you’re familiar with CPA Evolution.

The CPA Evolution initiative, announced by the American Institute of Certified Public Accountants (AICPA) in collaboration with the National Association of State Boards of Accountancy (NASBA), is set to transform CPA licensure model to recognize the changing competencies and skills required of practicing accountants today and in the future.

“This new licensure model will continue to place our profession in the best position to meet the needs of firms, organizations, clients, and the public we serve,” explains Susan S. Coffey, CPA, CGMA, chief executive officer – public accounting for the Association of International Certified Public Accountants in her article CPA Evolution: What’s Next. “It is also flexible enough to allow us to continue to evolve as market needs and our roles evolve in the future.”

How the CPA Exam Is Evolving

The AICPA developed the first CPA exam in 1917, which was offered twice per year. It was taken with pencil and paper and graded by hand, and until 1994, the use of calculators was prohibited. In 2004, the AICPA released its computerized exam, replacing the pencil-and-paper format, and in 2017, an updated version was released emphasizing application of skills over rote memory.

In 2021, the AICPA and NASBA jointly published the Accounting Program Curriculum Gap Analysis Report, which cites major gaps in college-level accounting programs, particularly in teaching emerging topics, such as IT governance and cybersecurity. Based on the findings of that report, the AICPA launched the CPA Evolution initiative to develop the newest iteration of the exam. This is the biggest change in the uniform CPA exam since it was introduced in 1917.

The New Exam: What Changes Are Coming in 2024?

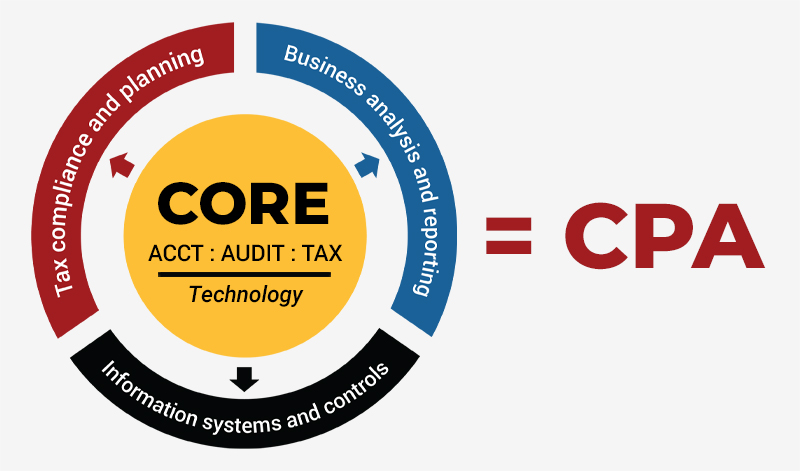

The structure is the most obvious change. The new model will retain three of the four existing CPA exam sections: auditing and attestation (AUD), financial accounting and reporting (FAR), and regulation (REG). All three core sections are assessed with technology infused into the multiple-choice questions and task-based simulations.

In addition, candidates will select one of three new discipline sections added for assessment (as indicated in the graphic from NASBA/AICPA): business analysis and reporting (BAR), information systems and controls (ISC)—which includes assessment on data analytics, information technology, and cybersecurity—and tax compliance and planning (TCP).

The exam remains four parts (3 core + 1 discipline) and will still take 16 hours to complete whereby each section of the exam is 4 hours long.

UMGC’s MS in CyberAccounting

Years before the AICPA announced CPA Evolution, UMGC’s graduate accounting and cybersecurity faculty developed a new Master of Science in CyberAccounting using a collaborative cross-disciplinary approach designed to help you gain synergistic knowledge in accounting and technology that CPA’s need to address the digital disruption facing today’s business organizations.

This 30-credit graduate degree is aligned with CPA Evolution’s strong emphasis on information systems, cybersecurity, and technology. The program provides coursework needed to succeed on the core sections and the new ICS discipline of the exam. It includes courses in information systems, cybersecurity, data analytics, digital forensics, information technology auditing, fraud, and risk management.

UMGC is the only university in the United States offering a CyberAccounting master’s degree with a heavy emphasis on the use of these emerging technologies. Every graduate accounting course requires assessments using data analytics. Preparing financial statements isn’t enough anymore; graduates must be well versed in using data analytic software and interpreting the results.

UMGC's MS in CyberAccounting degree is designed to help prepare you for the CPA exam and equip you for a career at the forefront of the accounting industry.

Reference on this webpage to any third-party entity or product does not constitute or imply endorsement by UMGC nor does it constitute or imply endorsement of UMGC by the third party.

Share This